Markup and tax calculator

15 100 20 markup. Markup price_after_taxes - cost cost markup markup x 100 markup 1666 - 5 5 markup 1166 5 markup 2332 markup 2332 x 100 markup.

If You Are Looking For A Flexible Way To Price Your Items And Still Add In Different Fees Based On The Dif Etsy Business Plan Pricing Templates Pricing Formula

Your company needs to.

. Markup percentage selling price - cost cost x 100 Abram inputs his numbers. Such a markup rate results in a margin such that for every 5 dollars in sales the business pockets 1 dollar in after accounting. Federal Income Tax Return Calculator Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator.

Divide 60000 by 08. Dont forget to include a percent for saving and giving and a percent for income tax. If the cost of the product is 125 and you need a profit margin of 20 on it.

How are markup margin and tax calculated. Gathering of all financial data about income earned by the company Under this step the information regarding the. 54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

This calculator doesnt tell you to increase or decrease mark-ups it simply tells you what they are. 50 Markup 330 Gross Profit 75 Markup 429 Gross Profit 100 Markup 500 Gross Profit You may also like to try our profitability calculator like Margin calculator The net profit. To determine his markup percentage he uses the formula.

Before-tax price sale tax rate and final or after-tax price. Mark up is calculated by dividing the gross profit by the original cost and then by multiplying the value that results by 100. Mark Up Calculator Mark Up.

All margin calculations exclude GSTVAT and any other taxes. To find markup percentage simply use this formula. Gross Profit Gross Profit P Selling price S Cost of the product.

The formula for calculating cost price from the selling price and markup percentage is as follows. Lets say you need to take home 60000 a year before taxes. To convert to percentage multiply by 100.

He includes 75 as his selling price. Gross profit value can be forecasted by two different formulas. Calculate the markup percentage of a product given its cost and desired gross margin.

Margin And Sales Tax Calculator Markup percentage markup cost x 100 Here are the steps to calculate. CODES 6 days ago Profit is not marked up by the 5000 commission markup because it is listed below the tax markup. To calculate the profit before tax these steps must be followed.

Cost price Selling Price 1 Markup100 Here is a step-by-step method with an example. What is the Markup M Selling.

Sales Tax Calculator

Markup Calculator And Discount Calculator

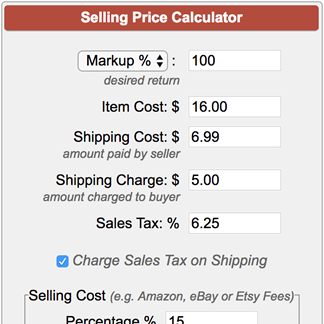

Selling Price Calculator

Sales Tax Calculator

Calculator Page 2 Enrgtech Calculator Desktop Calculator Basic Calculators

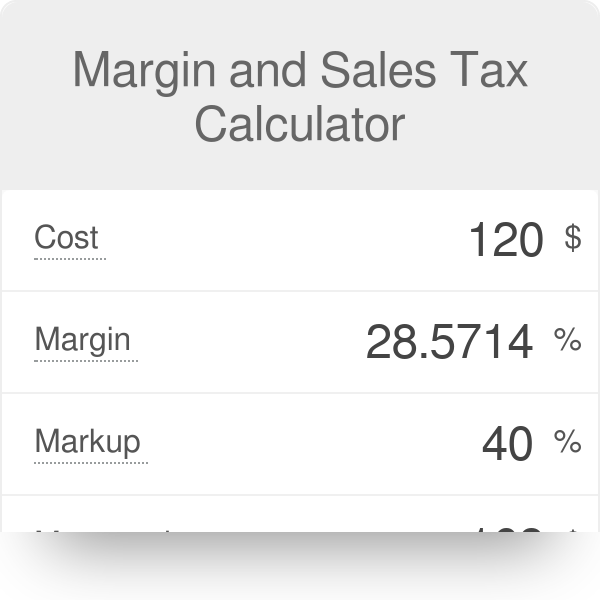

Margin And Sales Tax Calculator

Markup Calculator Omni Calculator Sales People Omni

Karce Kc 560t 12 12 Digits Large Desktop Tax Calculator Black Calculator Desktop Calculator Square Roots

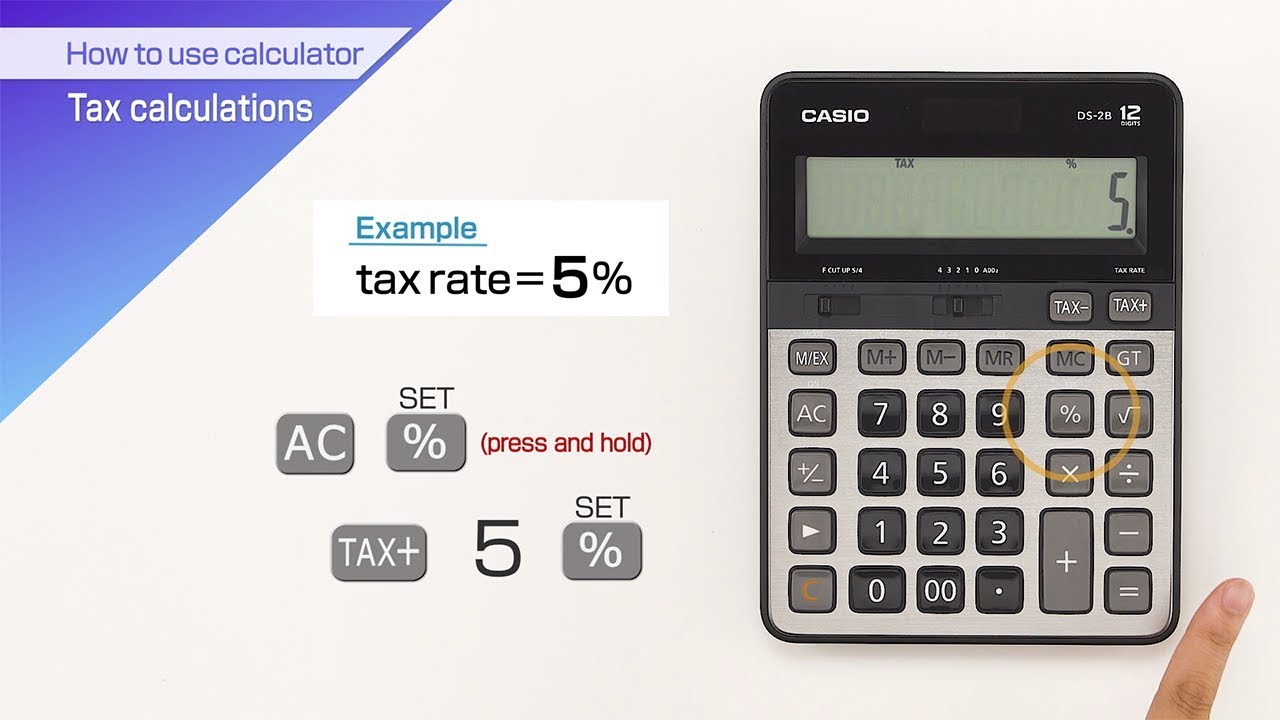

Casio How To Use Calculator Tax Calculations Youtube

Use The Online Margin Calculator To Find Out The Selling Price The Cost Or The Margin Percentage Itself How To Find Out Calculator Calculators

A Calculator With Words Genius Calculator App App Create Labels

Tip Sales Tax Calculator Salecalc Com

Net Profit Margin Calculator Bdc Ca

Monroe Sb1212 Monroe Calculators Red Ink

Net Profit Margin Calculator Bdc Ca

Casio Ms 808 Solar Desktop Calculator With 8 Digit Display

Gst Calculator How To Find Out Goods And Service Tax Tax Refund